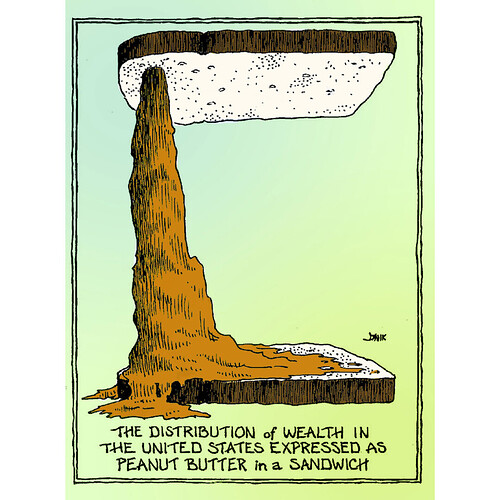

Personally, I’d have had more PB falling off the sides of the bottom level.

Ok but I’m pitching Tech-Brodiocracy as a song title or band name.

Greetings Elsewherians! This is my first day on watch, and you’ve already made me work. ![]()

A gentle reminder that it’s OK to criticize ideas, but personal attacks in response to criticism are not OK.

With their hit songs

- Cryptbro Currency

- Let Me Tell You About My Startup

- Dropping Broetry

- Living Up To My Brotential

- Brologue

- Bronumental

- Brovado

- Bros and Cons

- Brofessor with a BhD

It will never be as good as their debut album, The Side Hustle Side-eye

The feds were upset about lying to investors; never mind the leaking of student data. ![]()

Gee, it’s almost like the entire tech sector is now made up of nothing but lyin’ grifters looking to defraud people… but that can’t be true! So much money is involved!!! /s

They only investigate real crimes… /s ![]()

3 years ago, VCs in Bay Area tech were thriving. Now, they’re ‘bleeding cash.’

https://www.sfgate.com/tech/article/bay-area-venture-capital-bleeding-cash-laffont-19929955.php

Venture capital has long been a key engine powering the Bay Area’s dominant industry. For decades, deep-pocketed Silicon Valley investors have poured millions into promising technology startups up and down the Peninsula, funding risky bets that utterly flop or totally reorient our way of living. But now, those money managers are in historically troubled waters.

Over the past few years, a perfect storm of economic, regulatory and industry factors has mostly blocked tech startups from “exiting,” or cashing out through acquisitions or going public. As their job is to invest in new companies, watch them grow and then deliver their funders the rewards of an exit, this stagnancy is weighing heavily on venture capitalists. 2023 was venture’s worst year of profits since 2011, per data that industry tracker Pitchbook provided to SFGATE.

Initial public offerings, private equity buyouts and mergers are all proving hard to come by, making it hard for venture firms to recoup their cash.

Bluesky is having a moment. No, not that Bluesky, the other one.

The Canadian crypto company Bluesky Digital Assets Corp has seen its stock take off, in a manner of speaking, over the past week as investors buy up what they almost certainly think are shares of the other Bluesky, the social media platform that has been scooping up X-iles and recently hit 20 million users. […]

They’re still not out of the woods yet, but it looks like they’re on the right track.

Brecht was right, wasn’t he.

This is so messed up.

Would you mind elaborating on that? Right about what?

From The Threepenny Opera:

What is robbing a bank compared with founding a bank?

I see, thanks. He was indeed right. And I wonder how much more such fuckery is coming to a bank near us/me.

Except these (funded by Silicon Valley VC’s and hedge funds) fintech intermediaries between you and your bank aren’t banks.

And I don’t see what useful service they provide that a bank can’t. They’re just another grift - one step removed from “making your money clean”.

They should be required to be regulated and insured like banks- but that’s not going to happen going forward.

higher interest rates on offer, for innovative features or because they were turned away from traditional banks.

So, people were attracted by higher interest rates and a lot of customers probably had bad credit.