Tesla’s market capitalization was all smoke and mirrors before Elno started propping up T****. Now, there’s a breeze blowing and all those suckers who invested in it are seeing through the illusion.

I don’t understand why it hasn’t self corrected. Isn’t that what the market is supposed to do? The cars are not any more reliable than others on the market (if anything, less) and they sell a fraction of the big car companies yet are valued at 5-10x their price.

It’s definitely in the zone of conspiracy-theory: but any time a potent destroyer of western democracy (and that’s got to include musk inc) is financially propped-up (failing business ventures saved, political campaigns funded, Deutsche Bank loans made good…) one suspects international money flows. Mostly via putin or Saudi, one suspects.

That’s what they tell us, but we got to remember… the markets are not “free” things… they are based on the actions of people, sometimes lots and lots of people, who are not “rational” actors, as the right wing economists love to pretend, but… you know, people.

The Free market ideology is a lie and always has been, it’s just that markets are vast and complicated institutions, so they seem pretty opaque.

They shouldn’t stop there. This is Musk, make it 420%.

The Invisible Hand clutches it’s Invisible Pearls!

I suggest 1488%.

tedious terminology warning: the media is often referring to a surcharge that Canada is placing on exported electricity to the states as a “tariff”. it’s not, as far as anyone i know of is aware, a “tariff” if it’s out-going. a tariff is an import tax (which we all know ends up being paid by the consumer). if we permitted out-going charges to be called tariffs then trump’s blather that he is placing this “tariff”/charge on another country might have some standing - and we don’t want that (i don’t think)

example in dubious-ity:

Canada Slaps 25% Tariff on Electricity to Americans in Three States

“If the United States escalates, I will not hesitate to shut the electricity off completely,” Doug Ford said Monday.

By Matt Novak Published March 10, 2025

The leader of Ontario, Canada, made good on his threats to slap a 25% tariff on electricity sent to neighboring U.S. states on Monday. The tariffs are a direct response to President Donald Trump’s tariffs against Canada, a form of economic coercion with the goal of making Canada a state or territory of the United States.

addendum(dumdum): it’s possible that “tariff” originally meant charges going either way, as a generalized duty for crossing a border, but as of ~1900ish the US and UK designated a “tariff” to mean an import tax

-sigh-

As always, Reich gets it.

He’s been amzing lately-- Solnit, HCR and other bright lights too. Maybe we’re not quite at a point yet where, while the worst are full of passionate intensity, the best lack all conviction.

Yeah, it’s good to know that there are so many people willing to call shit out for what it is.

I have no idea. I’m not even sure what that means. All I know is I’ve lost, on paper, about $700 since the inauguration.

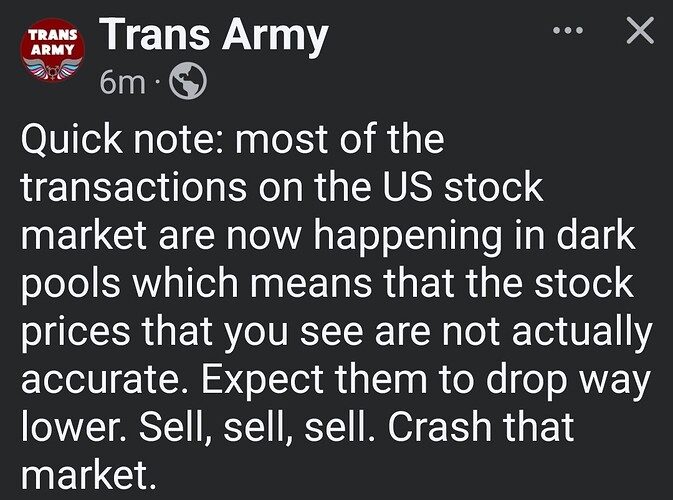

“ Dark Pool Trading: Key Statistics

- Trading Volume: As of February 2022, nearly half of all trading activity occurred in dark pools and off-exchange venues. For some stocks like GameStop, dark pool volume exceeded 50% of total trading on certain days.

- Number of Dark Pools: Over 50 dark pools were registered with the SEC in the U.S. as of February 2020.

- Growth Trend: Dark pools’ market share grew from 4% in 2005 to 18% by 2015.

- Order Size Trend: Average order size in dark pools decreased from 430 shares in 2009 to about 200 shares in 2013.

- Regulatory Action: In 2016, major financial institutions were fined over $150 million for violating federal laws in dark pool operations.”

Shit.

Huh. Yeah, that shouldn’t even be legal. More rigging of the system by the large institutional investors. I love how casually the drawbacks of dark pools are presented there:

- Lack of transparency

- Potential conflicts of interest

No shit. Which is exactly why they should be illegal. Goddammit capitalism sucks.

Thinking that we’ll see a small rise in the markets this morning as is not unusual after a big drop. Then another slide later or tomorrow.