As I contemplate the passage of President Donald Trump’s “Big Beautiful Bill” a few minutes ago, I can’t help but remember how I, and everyone else in Kansas, were sold the same bill of goods by our governor 13 years ago.

Former Gov. Sam Brownback ran almost exactly this same play in 2012. Income tax cuts weighted toward the wealthy, based on an underlying, but deeply flawed, theory that those cuts would spur a burst of economic growth the likes of which we had never seen. It was supposed to cover the damage from shortening one leg of the “three-legged stool” (income, sales and property taxes) that supports the state government.

The growth never materialized and the result of the “Brownback Tax Experiment” was perennial budget shortfalls, followed by traumatic cuts to public services.

It’s more than a bit chilling to hear the same “pro-growth” rhetoric Brownback used to pass the tax experiment, now on a national level justifying the Big Beautiful Bill.

This is from the press release Brownback issued when he signed the cuts into law in 2012:

“Our new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy. It will pave the way to the creation of tens of thousands of new jobs, bring tens of thousands of people to Kansas, and help make our state the best place in America to start and grow a small business.”

Compare that to this press release from the White House justifying the budget reconciliation bill that just passed:

“The One Big Beautiful Bill delivers the largest tax cut for working- and middle-class Americans in history. Put simply, President Trump’s One Big Beautiful Bill will unleash our economy and deliver a Blue-Collar BOOM.”

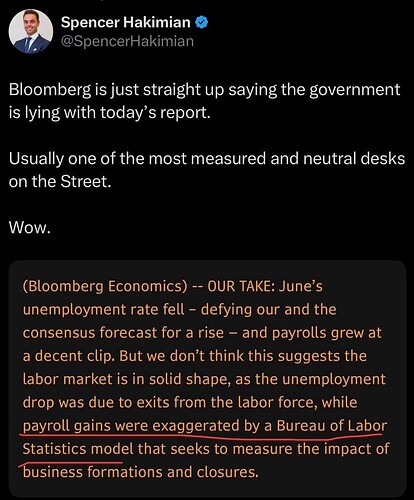

We’ll see.

When Kansas pioneered this, the most notable cuts were in education, which Brownback tried to hide via an accounting trick of redefining state support for schools as “block grants.” The state Supreme Court saw through it and eventually ordered the funding restored.

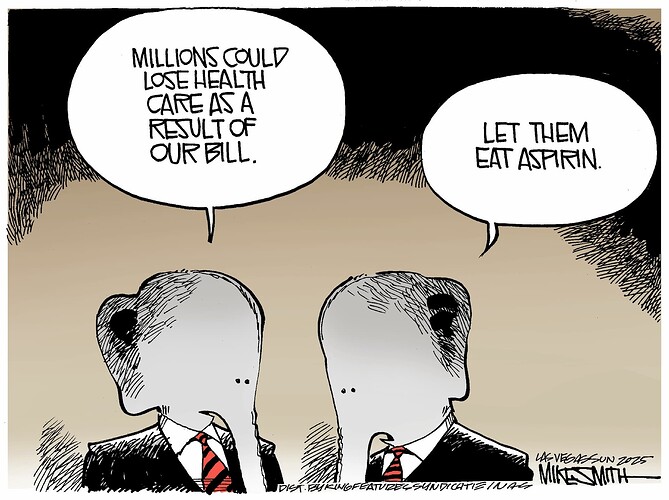

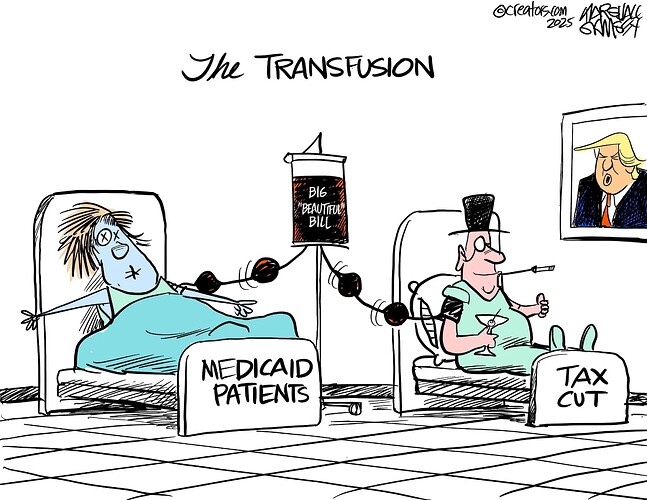

And Medicaid? Brownback privatized it and renamed it KanCare. When promised savings from that didn’t occur, he sliced $38 million from its budget, kicked 1,500 disabled Kansans to the curb, and cut payments to providers, laying the groundwork for the bankruptcy of rural hospitals across the state.

Brownback and his captive Legislature regularly conducted “sweeps” of state agencies that had their own independent sources of revenue, diverting user fees and taxes earmarked for specific purposes to try to plug the gaping holes he created in the general fund. The most famous example was sweeping gas tax money from roads and bridges — so much so that everyone started referring to the Kansas Department of Transportation as “The Bank of KDOT.”

In a desperation move, Brownback tried to fill the hole by messing with sales taxes. In 2010, the previous governor, a Democrat, asked for and got a three-year sales tax increase passed to help the state recover from the Great Recession. In 2013, Brownback, the mighty tax cutter, made most of that increase permanent.

It wasn’t nearly enough.

The Brownback Tax Experiment was ultimately repealed in 2017 by the Republicans, who mustered a two-thirds majority in the Legislature to override the governor’s veto (they were joined by Democrats, but there aren’t enough of them at the Statehouse for a decent game of red rover).

Trump rescued Brownback from an ignominious retirement to his farm in western Kansas by appointing him to a make-work job as United States Ambassador-at-Large for International Religious Freedom.

While Trump’s bill is mostly the same . . . stuff, different scale, there are some key differences between Kansas and the federal government:

-

Kansas lawmakers and governors are required to pass a balanced budget each year, so they couldn’t default to deficit spending, like the Big Beautiful Bill does. It’s currently forecast to add approximately $3.3 trillion to the national debt over the next 10 years.

-

Unlike Brownback, Trump doesn’t have a sales tax to raise to try to offset his mistakes. But he does have the next best thing, tariffs, which act as a de facto sales tax on imported goods.

Three months ago, I wrote about how the price of tires for my car went from $58 each to $66 within 24 hours of Trump announcing his “Liberation Day” tariff hikes. Now, they’re $85, where you can find them.

So by now, you’re probably thinking, “Hey Dion, why didn’t you write about all this before Congress passed Trump’s bill, so they’d have been warned?”

To that, I’d ask, “Why would you think it would have made any difference?”

My own congressman, Ron Estes, was Kansas state treasurer during the Brownback Tax Experiment. He had a front-row seat for the entire movie and knows how it ends.

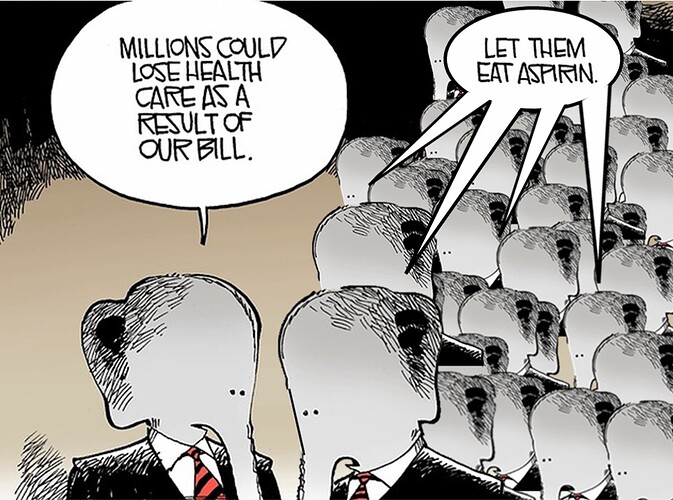

Estes is now one of the Big Beautiful Bill’s most ardent supporters.

They say the definition of insanity is doing the same thing over and over and expecting a different result. They’re wrong. In 2025, it’s the definition of good politics for Republican office holders like Trump and Estes.

You see, the hole card Trump has — that Brownback didn’t — is control over the immigration apparatus of government. The Big Beautiful Bill will shower an extra $100 billion on immigrant detention, border walls and deportation.

The bill will undoubtedly hurt millions of Republicans. But if there’s one guiding principle of the MAGA movement that currently dominates GOP politics, it’s that it’s willing to endure any level of suffering, as long as the Mexican family next door gets it worse.

So see you in five years or so when the Big Beautiful Bill crashes and burns like the Brownback Tax Experiment. Until then, keep your seat belt fastened and your seatback in the upright and locked position.

It’s gonna be a rough ride.